For any property manager staring at a capital expenditure request, the appeal of occupancy sensors is immediate and powerful. The logic seems unassailable: lights and HVAC systems running in empty rooms are a pure waste of money. Turning them off automatically should yield a clear and convincing return on investment. The calculation itself feels like a formality, a simple confirmation of an obvious truth.

This is the first, and most dangerous, assumption. A simple ROI formula, based on estimated energy reduction, is more than just incomplete. It is a dangerously misleading story. A true financial analysis must move beyond the clean lines of a spreadsheet and into the messy operational realities of a multi-tenant building. It requires an accounting of costs that hide in plain sight and a recognition of value that an energy bill will never show. The real question is not what the formula says, but whether the numbers you put into it reflect reality.

The Seduction of a Simple Formula

The foundational equation for ROI is seductive in its simplicity. You take the annual financial gain, subtract the total cost, and divide it by that same cost. The result is a clean percentage, an answer that seems to promise certainty. But the variables within this equation, “gain” and “cost,” are not simple inputs. They are deep categories, each containing overlooked complexities and hidden expenses that can quietly invert the outcome of the entire project.

For larger, portfolio-wide decisions, a Chief Financial Officer will likely push for a more sophisticated metric like Net Present Value, which accounts for the time value of money. This method discounts future savings over the sensor’s lifespan to determine if the project is financially sound from the outset. Yet even this more rigorous approach is only as reliable as the numbers it uses. The real work is not in the calculation, but in the honest investigation of what those numbers truly represent.

The True Anatomy of “Cost”

The most common error begins with underestimating the total cost of investment. The price of the sensors themselves is merely the visible peak of a much larger mountain. A comprehensive accounting must dig into the labor required not just to mount the hardware, but to make it function as an intelligent system. This includes the electrician’s time running wires and the specialized technician’s hours spent programming schedules, defining time delays, and integrating every sensor into the building’s central management system.

This is where the age of a building can completely derail an otherwise positive ROI. In older structures, the task of running new low-voltage wires can become an expensive ordeal of coring through concrete and navigating decades of previous renovations. The labor and materials for such an installation can easily eclipse the cost of the hardware itself. Suddenly, a wireless sensor system, which may seem more expensive on the initial quote, becomes the more financially prudent option. Its higher hardware price is often more than offset by the dramatic reduction in installation labor. A true cost analysis weighs these two scenarios not just on their upfront price tags, but on the total project expense, including the long-term operational cost of replacing batteries in a wireless network.

Maybe You Are Interested In

Expanding the Definition of “Financial Gain”

Just as “cost” is more than hardware, “gain” extends far beyond simple energy savings. The most obvious return comes from reduced electricity consumption for lighting, a figure that can be estimated with reasonable accuracy. By calculating the total wattage controlled, the hours of operation, and a conservative percentage for the reduction in “on” time, you can project a reliable annual saving. A 30% reduction is a common, and often achievable, target.

But a significant portion of a building’s energy profile is driven by its HVAC system. Modern sensors that integrate with the building’s BMS unlock a far greater potential for savings. When a sensor detects a space has been empty for twenty minutes, it can signal the system to relax the temperature, preventing the costly exercise of heating or cooling empty offices to precise levels of human comfort. This saving is more complex to quantify than lighting, but your HVAC contractor can provide realistic estimates based on reduced runtime. This figure, added to the lighting savings, begins to paint a more complete picture of the financial return.

The most advanced and often most valuable gain, however, has nothing to do with energy. The occupancy data itself transforms the sensor from a simple switch into a strategic asset management tool. If data reveals that a tenant’s space is consistently empty on Fridays, that information provides objective justification for reducing cleaning services or adjusting security patrols. The true strategic power appears during lease negotiations. Data proving that a tenant leasing 10,000 square feet consistently uses only 40% of that space provides immense, undeniable leverage. The financial gain from subleasing the underutilized portion or rightsizing the tenant’s footprint at renewal can dwarf years of accumulated energy savings.

The Slow Erosion of Your Return

An ROI calculation that stops here, balancing a comprehensive cost against an expanded gain, is still incomplete. The analysis must account for the small, recurring operational costs that act like a slow leak, eroding the net return over time. A sensor that saves fifty dollars a year in energy but requires seventy-five dollars in annual battery replacement and maintenance labor is not an investment. It is a liability.

These ongoing costs are not trivial. Many networked systems require annual subscription fees for software or cloud data services. When sensors malfunction or generate tenant complaints, staff hours are consumed in troubleshooting. Even the initial training for staff and tenants represents a real operational expense. An honest financial projection must subtract these persistent costs from the gross annual gain to arrive at a true net return.

From Calculation to Implementation

Ultimately, a successful project depends less on the initial calculation and more on a thoughtful rollout. The most significant non-financial risk is tenant friction. Proactive communication is essential, framing the project as a green initiative and clarifying that sensors detect only heat and motion, not identities, to preempt privacy concerns.

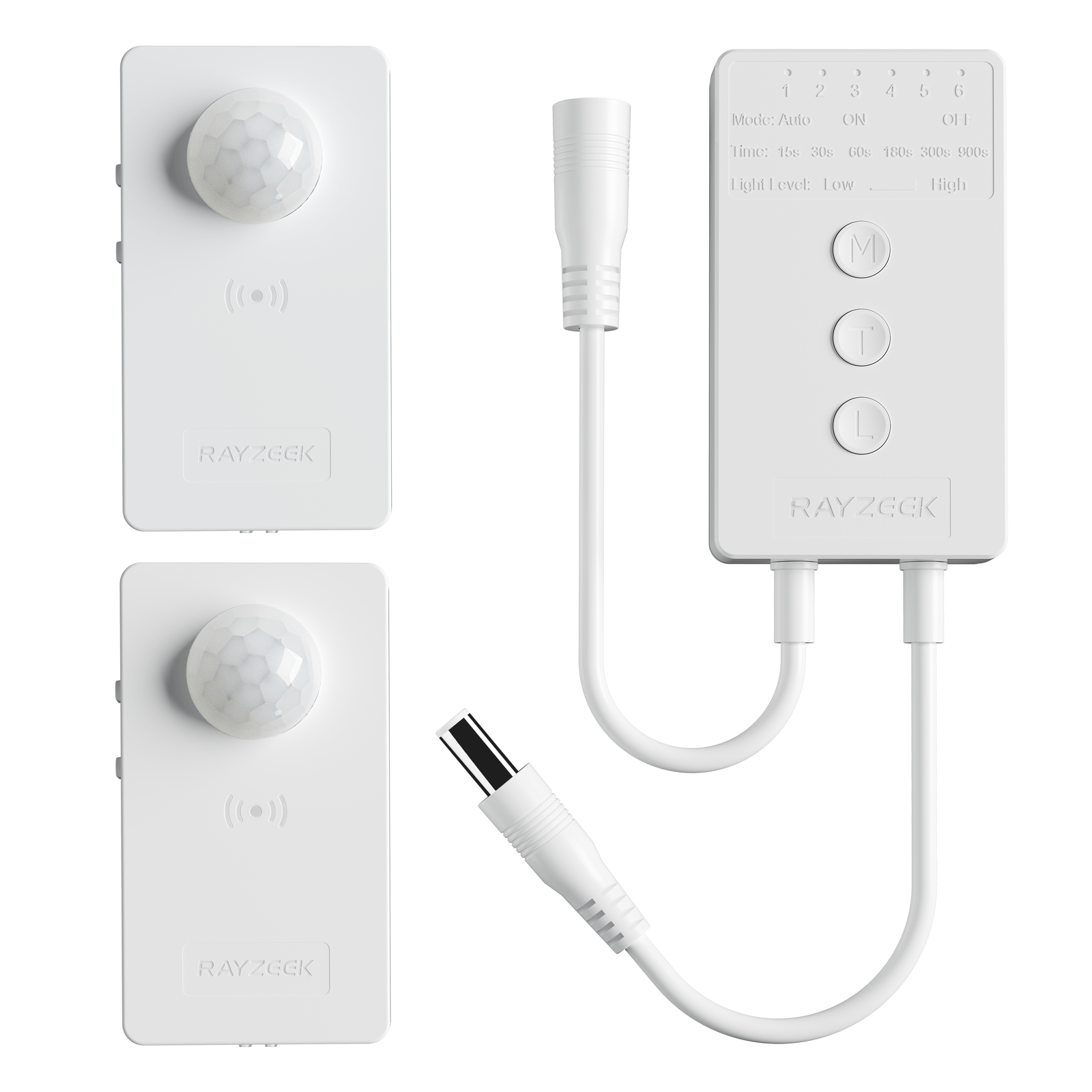

Looking For Motion-Activated Energy-Saving Solutions?

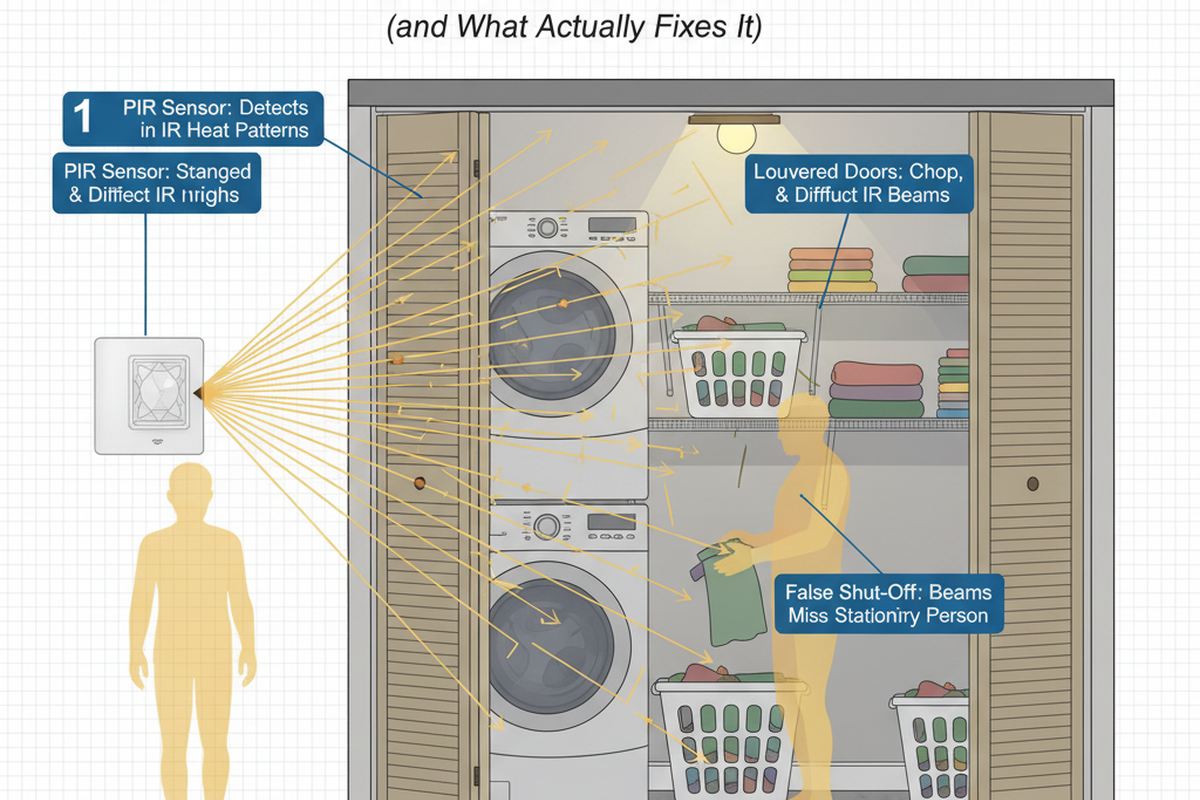

Contact us for complete PIR motion sensors, motion-activated energy-saving products, motion sensor switches, and Occupancy/Vacancy commercial solutions.

The most effective way to mitigate financial risk is to replace assumptions with evidence. A pilot program on a single, representative floor provides hard data on actual energy reduction. By sub-metering the area for 60 or 90 days, you can build a defensible, data-backed projection for a building-wide installation, turning a speculative investment into a predictable one.

This practical approach helps avoid the single biggest mistake managers make: setting the time delay before lights turn off too short. A five-minute delay, chosen to maximize savings on paper, inevitably leads to a flood of complaints from employees sitting still at their desks. This encourages manual overrides, negating the system’s purpose entirely. A more patient delay of 15 or 20 minutes, however, captures nearly all of the potential savings with virtually zero disruption. It is a perfect illustration of the project’s true goal: not theoretical perfection, but sustainable, long-term savings that work in a real, human environment.